Goodwill Itemized Donation List Printable - Web though you may have the best intentions with some of your donations, there are some items goodwill will not accept. You can find all donation sites here. And canada donate to goodwill, knowing their clothing and household goods will be put to good use. Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. To determine the fair market value of an item not on this list, use 30% of the item’s original price. Web goodwill donated goods value guide clothing & accessories the u.s. The donor determines the fair market value of an item. Internal revenue service (irs) requires donors to value their items. Web about goodwill industries international.

Itemized Donation List Printable Goodwill Master of

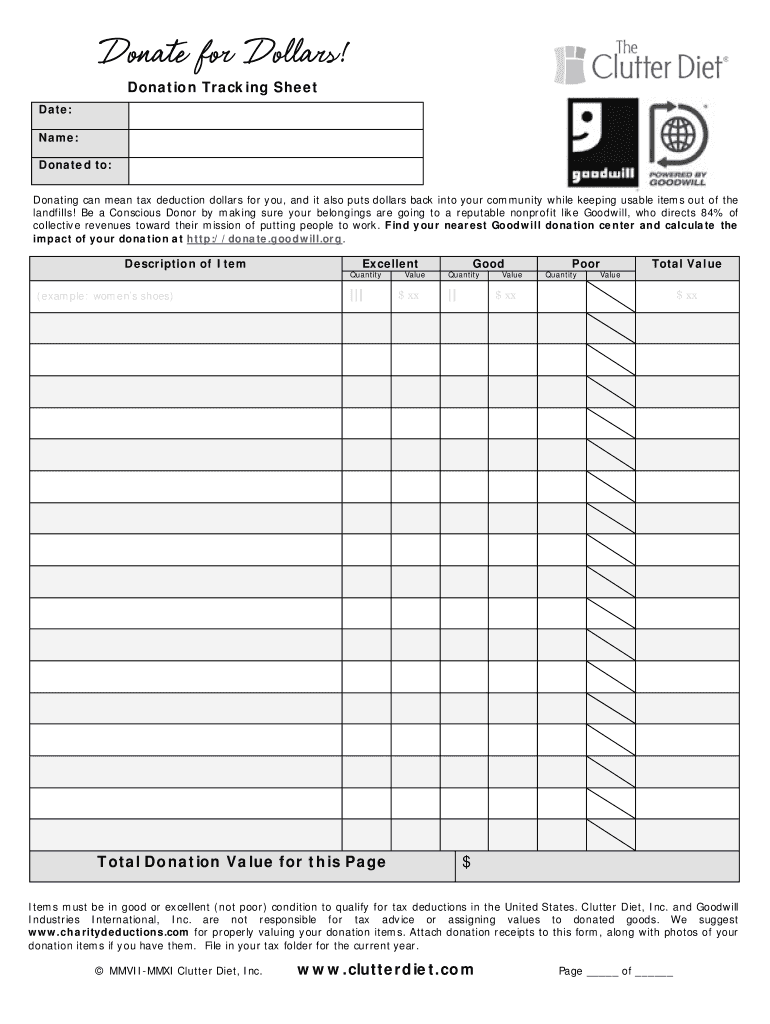

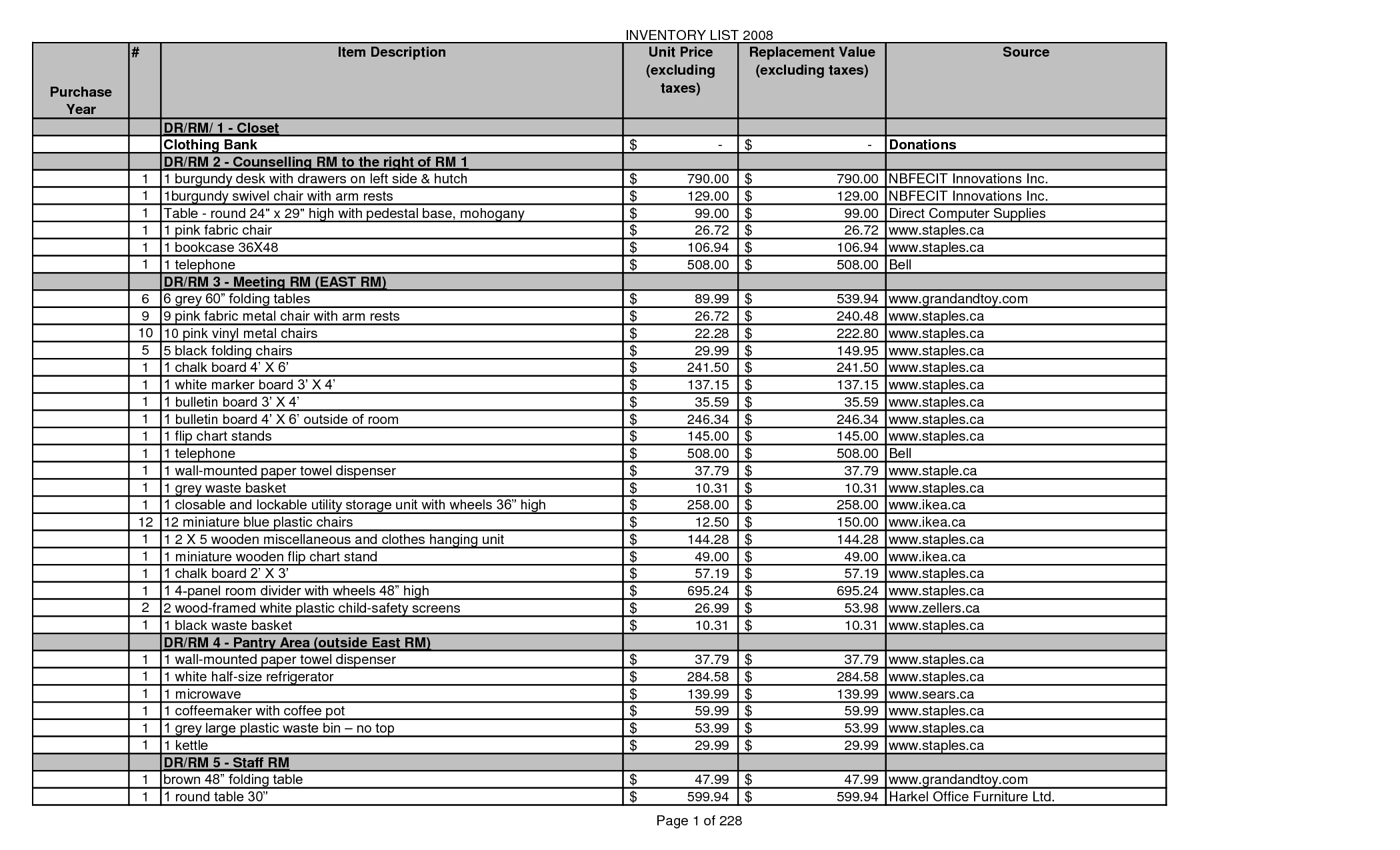

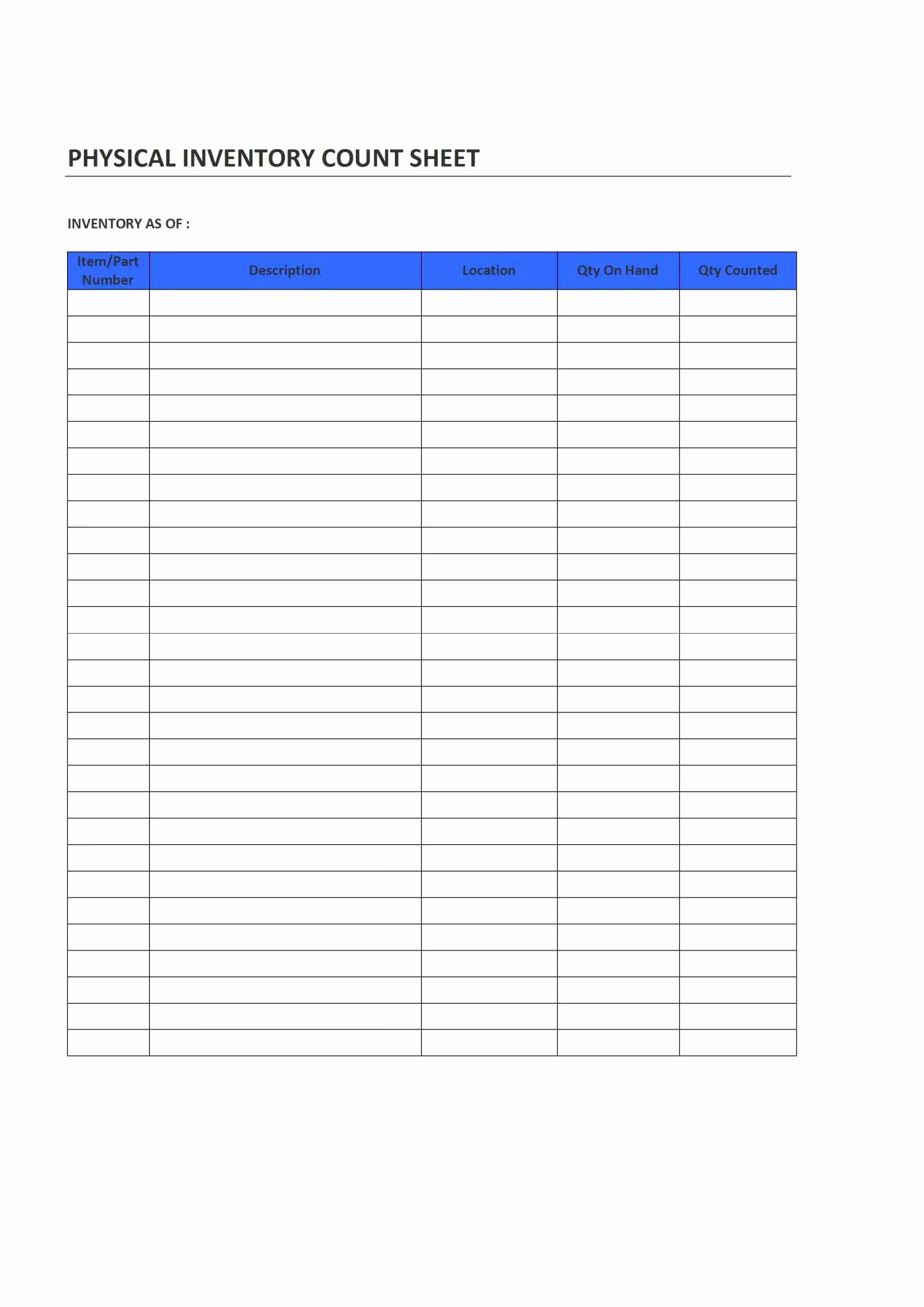

And the total estimated value of the donation. Web these guides are useful because they typically focus on the items most commonly donated items. Prices are only estimated values. Fill out the donation receipt form and specify each item you donated. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in.

Itemized Donation List Printable Goodwill Master of

To find a list of items we cannot accept, please scroll to the next section. Unsold items get one last chance at the goodwill Web clothing and shoes coats and boots books, records, cds, videotapes, and dvds housewares, dishes, glassware, and small appliances collectibles and home décor working home electronics, flat screen tvs and more! Web about goodwill industries international..

Tax Donation Spreadsheet within Itemized Spreadsheet Template Lovely

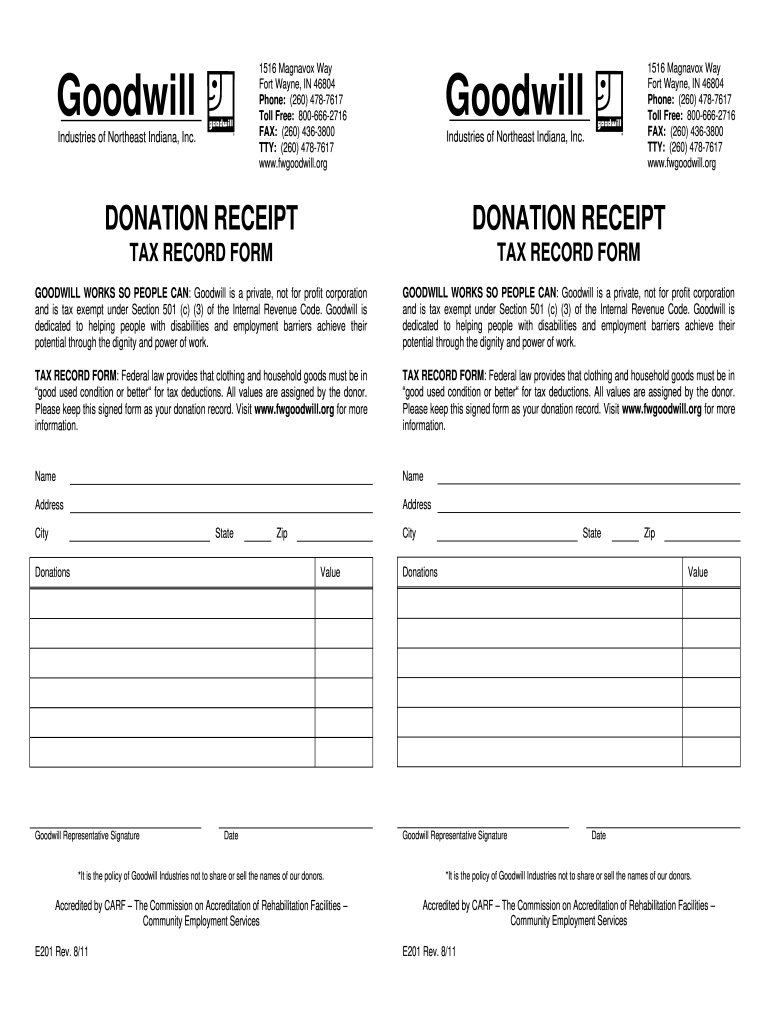

For information on rights and services to persons with developmental disabilities contact: Goodwill industries international supports a network of more than 150 local goodwill organizations. Fill out the donation receipt form and specify each item you donated. Goods or services were not provided in exchange for the donation. The latter should contain the acquisition process description.

printable goodwill donation receipt that are zany miles blog free 20

Habitat for humanity, on the other hand, emphasizes construction supplies. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Many.

printable goodwill donation receipt that are zany miles blog 20

Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. To help guide you, goodwill industries international has compiled a list.

goodwill donations list Google Search Goodwill, Goodwill donations

Plus, all assets must be appraised beforehand. Total assets worth 5,000 usd and more. Fill out the donation receipt form and specify each item you donated. Web we look forward to continuing our support for goodwill, as they aim to help even more people reach their full economic potential. Unsold items get one last chance at the goodwill

8 Best Images of Donation List Template Printable Free Printable

Local organizations will sometimes provide guides as well. Web goodwill donation receipt template. Web these guides are useful because they typically focus on the items most commonly donated items. Goods or services were not provided in exchange for the donation. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on.

Fresh 40 Donation Receipt Templates & Letters [goodwill Non Profit

When you donate to goodwill, your stuff gets a second chance in another person’s life instead of laying in a landfill. Your donations to goodwill are tax deductible. Total assets worth 5,000 usd and more. Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. To.

Goodwill Donation Excel Spreadsheet Fresh Goodwill Donation Excel

Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. Web goodwill accepts donations of gently used items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Web include your clothing costs with your.

Itemized Donation List Printable Goodwill Master of

Our stores take gently used items in good condition. Through google.org's support of goodwill and programs like the google career certificates, more than 300,000 americans have been placed into digital economy jobs. Local organizations will sometimes provide guides as well. Determining a donated item's fair market value the irs uses fair market value (fmv) to establish the amount you can.

Web goodwill accepts donations of gently used items. Internal revenue service (irs) requires donors to value their items. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Tax benefits are available to taxpayers that itemize deductions. Local organizations will sometimes provide guides as well. To determine the fair market value of an item not on this list, use 30% of the item’s original price. More than 101 million people in the u.s. Web we look forward to continuing our support for goodwill, as they aim to help even more people reach their full economic potential. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web though you may have the best intentions with some of your donations, there are some items goodwill will not accept. Web goodwill donated goods value guide clothing & accessories the u.s. High quality & unique items sell in our thrift stores & online at mokangoodwill.org/shoponline. Habitat for humanity, on the other hand, emphasizes construction supplies. The latter should contain the acquisition process description. For information on rights and services to persons with developmental disabilities contact: And canada donate to goodwill, knowing their clothing and household goods will be put to good use. To find the goodwill headquarters responsible for your area, visit our locator. Many of these items fit into categories, such as cleaners and chemicals, large appliances, and mattresses, among others.

When You Donate To Goodwill, Your Stuff Gets A Second Chance In Another Person’s Life Instead Of Laying In A Landfill.

The latter should contain the acquisition process description. Goodwill, for example, lists clothing items and home goods. Goodwill does not retain a copy of the tax receipt. Tax benefits are available to taxpayers that itemize deductions.

Our Stores Take Gently Used Items In Good Condition.

Total assets worth 5,000 usd and more. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web goodwill donation receipt template. Unsold items get one last chance at the goodwill

Goods Or Services Were Not Provided In Exchange For The Donation.

Internal revenue service (irs) requires donors to value their items. Determining a donated item's fair market value the irs uses fair market value (fmv) to establish the amount you can deduct for almost all donated items. Internal revenue service (irs) requires donors to value their items. For information on rights and services to persons with developmental disabilities contact:

Donation Record Form, Goodwill Printable Form, Goodwill.

Web your support will help goodwill® equip community members with the skills they need to get back to work and have the opportunity to thrive. Web about goodwill industries international. Prices are only estimated values. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip).